Smart Money Moves: Optimize Your Spending Plan in 6 Months

Smart money moves involve optimizing your spending plan by identifying areas for savings, setting clear financial goals, and automating investments over the next six months to improve financial stability and growth.

Are you looking for smart money moves to enhance your financial health? Over the next six months, you can significantly improve your financial situation by optimizing your spending plan and making strategic financial decisions. Let’s dive in!

Understanding Your Current Financial Situation

Before making any adjustments, it’s essential to understand where your money is currently going. Assessing your income, expenses, and debts provides a clear foundation for creating a more efficient spending plan.

Assess Your Income and Expenses

Begin by tracking all sources of income, including salary, investments, or side hustles. Next, meticulously document all expenses, categorizing them into fixed expenses (e.g., rent, mortgage, insurance) and variable expenses (e.g., groceries, entertainment, dining out).

Identify Spending Patterns

Once you’ve tracked your expenses for a month or two, analyze the data to identify spending patterns. Look for areas where you might be overspending or where you can cut back without significantly impacting your quality of life. Tools like budgeting apps or spreadsheets can help visualize this data.

To summarize, understanding your current financial situation involves:

- Tracking all income sources

- Documenting and categorizing all expenses

- Analyzing spending patterns to identify areas for optimization

By meticulously reviewing your income and expenses, you’ll gain valuable insights into your financial behavior, laying the groundwork for effective changes.

Setting Clear Financial Goals for the Next 6 Months

Having well-defined financial goals provides direction and motivation for sticking to your optimized spending plan. Whether it’s saving for a down payment, paying off debt, or building an emergency fund, specific goals make it easier to prioritize your spending.

Define Short-Term and Mid-Term Goals

Set realistic and achievable goals that you can accomplish within the next six months. Short-term goals might include reducing your monthly spending by a certain percentage or saving a specific amount. Mid-term goals could involve paying off a small credit card balance or building a starter emergency fund.

Prioritize Your Goals

Rank your goals based on their importance and urgency. Prioritizing helps you allocate your resources effectively and ensures that you focus on the most critical objectives first. For example, paying off high-interest debt should generally take precedence over saving for discretionary purchases.

In setting and prioritizing your financial goals, consider:

- Defining specific, measurable, achievable, relevant, and time-bound (SMART) goals

- Ranking goals based on importance and urgency

- Relating goals to your overall financial well-being

By setting concrete, prioritized goals, you’ll have the impetus to make smart money moves and adhere to your spending plan.

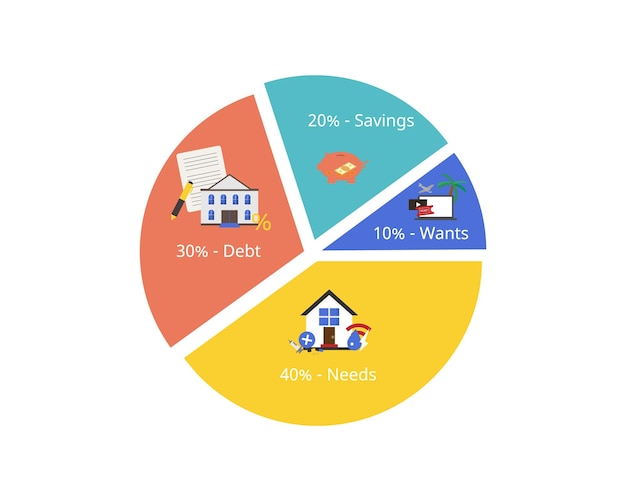

Optimizing Your Budget: The 50/30/20 Rule

The 50/30/20 rule is a simple budgeting framework that can guide your spending decisions and help you allocate your income effectively. It suggests dedicating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Understand the Framework

Needs encompass essential expenses like housing, transportation, groceries, and utilities. Wants include discretionary spending on things like dining out, entertainment, and travel. Savings and debt repayment allocates funds to building an emergency fund, investing, and paying down debts.

Adjust the Rule to Fit Your Circumstances

While the 50/30/20 rule provides a useful guideline, it’s crucial to tailor it to your specific financial situation. For example, if you have high debt levels, you might need to allocate more than 20% to debt repayment. Similarly, if you live in an expensive area, your needs might consume more than 50% of your income.

Applying the 50/30/20 rule entails:

- Understanding the components of needs, wants, and savings/debt

- Adjusting the percentages to reflect your unique financial situation

- Regularly reviewing and refining your budget

By employing and adapting the 50/30/20 rule, you can create a more balanced and effective spending plan.

Automating Savings and Investments

Automating your savings and investments is a powerful strategy for ensuring consistent progress towards your financial goals. Setting up automatic transfers to savings accounts and investment accounts eliminates the need for manual effort and reduces the temptation to spend that money elsewhere.

Setting Up Automatic Transfers

Arrange for a portion of your paycheck to be automatically transferred to your savings or investment accounts on each payday. Most banks and brokerage firms offer this feature, allowing you to specify the amount and frequency of transfers.

Investing in Retirement Accounts

Take advantage of employer-sponsored retirement plans like 401(k)s or 403(b)s, especially if your employer offers matching contributions. Automate contributions to these accounts to ensure you’re consistently saving for retirement. Consider also setting up automatic investments in Roth IRAs or traditional IRAs.

The key advantages of automating savings and investments include:

- Ensuring consistent contributions to savings and investment accounts

- Eliminating the need for manual transfers

- Taking advantage of compounding returns over time

By implementing automation, you can remove barriers to saving and investing, making it easier to achieve your long-term financial objectives.

Reducing Debt and Negotiating Lower Rates

High-interest debt can be a significant drain on your finances. Taking steps to reduce your debt burden and negotiate lower interest rates can free up more money to allocate towards other financial goals.

Debt Snowball vs. Debt Avalanche Methods

The debt snowball method involves focusing on paying off the smallest debt first, regardless of interest rate. The debt avalanche method prioritizes paying off debts with the highest interest rates first. Each approach has its merits; the snowball method provides quick wins, while the avalanche method saves more money in the long run.

Negotiating with Creditors

Contact your credit card companies and other lenders to negotiate lower interest rates or payment plans. Explain your situation and ask if they can offer any assistance. Many creditors are willing to work with borrowers who are proactive in addressing their debt.

Key strategies for debt reduction and negotiation include:

- Choosing a debt repayment method that aligns with your preferences

- Consolidating high-interest debts into a lower-interest loan

- Negotiating lower interest rates with creditors

By aggressively addressing debt, you can reduce financial stress and improve your overall financial stability.

Tracking Progress and Adjusting Your Plan

Regularly monitoring your progress is essential for staying on track with your spending plan. Tracking your income, expenses, savings, and debt levels allows you to identify potential problems and make necessary adjustments.

Using Budgeting Apps and Spreadsheets

Utilize budgeting apps or spreadsheets to track your financial data. These tools can provide valuable insights into your spending habits and help you identify areas where you’re exceeding your budget or falling short of your goals. Regularly review your data and make adjustments as needed.

Regularly Reviewing Your Finances

Set aside time each month to review your finances and assess your progress towards your goals. Evaluate whether your spending plan is working effectively and make adjustments based on your findings. This ongoing process ensures that your plan remains aligned with your evolving financial needs.

Effective tracking and adjustment of your spending plan involve:

- Using tools like budgeting apps and spreadsheets

- Regularly reviewing your financial data

- Adapting your plan to changing circumstances

By consistently tracking and adjusting, you can optimize your spending plan and enhance your financial outcomes.

| Key Point | Brief Description |

|---|---|

| 📊 Assess Finances | Track income and expenses to understand spending patterns. |

| 🎯 Set Goals | Define SMART financial goals for the next 6 months. |

| 💰 Optimize Budget | Apply the 50/30/20 rule to balance needs, wants, and savings. |

| 🔄 Track Progress | Regularly monitor and adjust your plan for optimal results. |

Frequently Asked Questions

▼

Begin by tracking your income and expenses for at least a month. This will give you a clear picture of where your money is going and highlight areas where you can cut back.

▼

The 50/30/20 rule provides a simple framework for allocating your income: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

▼

Automating savings ensures consistent contributions to your savings and investment accounts, making it easier to reach your financial goals without manual effort.

▼

Consider using the debt snowball or debt avalanche method. You can also negotiate with creditors for lower interest rates or payment plans.

▼

You should review your spending plan at least once a month to track your progress and make any necessary adjustments based on your financial situation.

Conclusion

By implementing these smart money moves and following these strategies, you can significantly optimize your spending plan over the next six months. Understanding your current financial situation, setting clear goals, optimizing your budget, automating savings, reducing debt, and tracking progress are all essential steps towards achieving financial stability and long-term financial success.