Debt Snowball vs. Avalanche: Which Repayment Strategy Wins?

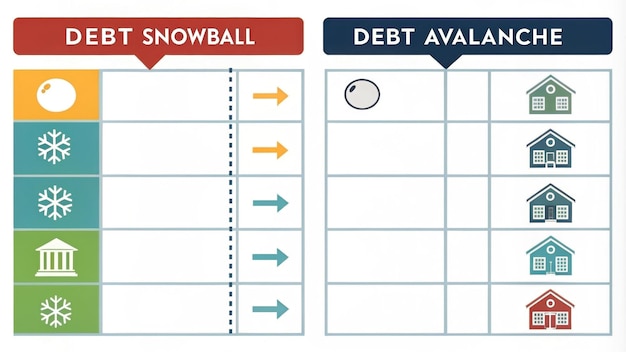

The debt snowball and debt avalanche are two popular debt repayment strategies; while the debt snowball focuses on psychological wins by paying off the smallest balances first, the debt avalanche prioritizes saving money on interest by tackling debts with the highest interest rates first.

Feeling overwhelmed by debt? Choosing the right repayment strategy can make all the difference. Let’s explore the debt snowball vs. debt avalanche: which strategy saves you more money in the long run?

Understanding the Debt Snowball Method

The debt snowball method is a debt reduction strategy where you pay off your debts in order from smallest to largest, regardless of the interest rate. This approach focuses on providing quick wins to keep you motivated. Let’s delve deeper into the details of this method.

How the Debt Snowball Works

The debt snowball method begins by listing all your debts from the smallest balance to the largest balance. You make minimum payments on all debts except the smallest, where you throw every extra dollar you can find. Once the smallest debt is paid off, you take the money you were paying on it and add it to the minimum payment of the next smallest debt, creating a “snowball” effect.

Benefits of the Debt Snowball Method

One of the biggest advantages of the debt snowball method is the psychological boost it provides. Seeing debts disappear quickly can be highly motivating. This momentum can help you stay focused and committed to your debt repayment plan. It can also be a great option for those who need motivation to eliminate debt.

- Provides quick wins and boosts motivation.

- Simple to understand and implement.

- Helps build momentum in debt repayment.

The debt snowball approach is particularly appealing to individuals who get easily discouraged by slow progress. The instant gratification can provide the necessary drive to tackle even larger debts down the line.

Exploring the Debt Avalanche Method

The debt avalanche method is a debt reduction strategy where you prioritize paying off debts with the highest interest rates first, regardless of the balance size. This approach can save you the most money in the long run. Here’s a closer look at how it works and its benefits.

How the Debt Avalanche Works

To use the debt avalanche method, you list all your debts along with their respective interest rates. You then focus on paying off the debt with the highest interest rate as aggressively as possible, while making minimum payments on all other debts. Once the highest interest debt is paid off, you move on to the debt with the next highest interest rate, and so on.

Financial Advantages of the Debt Avalanche

The primary benefit of the debt avalanche method is that it saves you the most money on interest over time. By targeting high-interest debts first, you reduce the overall cost of borrowing. This can free up more money in the long run to put towards other financial goals.

- Saves the most money on interest.

- Reduces the overall cost of borrowing.

- Mathematically the most efficient approach.

This method is favored by those who are disciplined and comfortable with delaying gratification in favor of long-term financial benefits. It’s a logical and mathematically sound approach to debt reduction.

Debt Snowball vs. Debt Avalanche: Which Saves More Money?

When comparing the debt snowball vs. debt avalanche: which strategy saves you more money in the long run?, the avalanche method almost always comes out on top in terms of pure economics. However, the best method depends on your individual financial situation and psychological preferences.

The Math Behind the Savings

The debt avalanche method directly addresses the highest interest rates first, reducing the amount of interest you pay over the life of your debts. This can translate to significant savings, especially if you have debts with high interest rates, such as credit card debt. The snowball method, while motivating, may end up costing you more in interest.

Psychological Factors and Motivation

The debt snowball method’s strength lies in its ability to provide quick wins, which can be a powerful motivator. If you are the type of person who needs to see progress quickly to stay engaged, the snowball method might be the better choice. The avalanche method, while more financially efficient, can feel slower and less rewarding in the short term.

The choice between these methods isn’t just about the numbers; it’s also about understanding your own behavior and what will keep you committed to the process.

Real-life Scenarios: Debt Snowball in Action

To better illustrate how the debt snowball method works, let’s consider a few real-life scenarios. These examples can highlight the practicality and motivational benefits of this debt repayment strategy.

Scenario 1: Boosting Confidence

Imagine Sarah has three debts: a $500 credit card balance, a $2,000 personal loan, and a $5,000 car loan. Sarah starts by attacking the $500 credit card debt. After paying it off in a few months, she feels a huge sense of accomplishment, boosting her confidence to tackle the larger debts.

Scenario 2: Maintaining Momentum

John has several small debts, including medical bills and small credit card balances. He opts for the debt snowball method to gain early momentum. As he eliminates each small debt, he feels encouraged and maintains a steady pace in his debt repayment journey.

- Great for individuals needing quick wins.

- Ideal for those who are easily discouraged.

- Helps build consistent repayment habits.

These scenarios demonstrate how the debt snowball method can work effectively when motivation is a key factor.

Real-life Scenarios: Debt Avalanche in Action

Let’s examine how the debt avalanche method can be applied in real-life situations to maximize financial savings. These examples will show the effectiveness of this approach.

Scenario 1: Minimizing Interest Payments

Consider Michael, who has a credit card with a $3,000 balance and a 20% interest rate, a personal loan with a $5,000 balance and a 10% interest rate, and a student loan with a $10,000 balance and a 5% interest rate. Michael chooses the debt avalanche method and focuses on paying off the credit card first, saving him a significant amount in interest over time.

Scenario 2: Long-Term Financial Planning

Lisa has multiple high-interest debts and a solid financial plan. She prioritizes the highest interest debt, even though it’s not the smallest balance. This strategic approach reduces her overall debt repayment costs, allowing her to achieve her long-term financial goals sooner.

- Saves money on interest payments.

- Best for disciplined individuals.

- Maximizes long-term financial benefits.

These scenarios highlight the financial advantages of the debt avalanche method when applied correctly.

Making the Right Choice for You

When deciding debt snowball vs. debt avalanche: which strategy saves you more money in the long run?, consider your personal circumstances, financial goals, and psychological makeup. Here are some key factors to keep in mind.

Assess Your Financial Situation

Evaluate your current debts, interest rates, and overall financial health. If you have high-interest debts, the avalanche method might be the more logical choice. If your debts are relatively low interest, the snowball method could provide the necessary motivation to start.

Consider Your Personality

Think about what motivates you. Do you need to see quick results to stay engaged? Or are you comfortable with a slower but more financially efficient approach? Understanding your personality can help you choose the method that is most likely to succeed for you. Success in debt repayment is all about behavioural change in the long term.

Ultimately, the best debt repayment strategy is the one you can stick with. Whether you choose the debt snowball or the debt avalanche, commitment and consistency are key to achieving your financial goals.

| Key Point | Brief Description |

|---|---|

| 💰 Debt Snowball | Focuses on paying off smallest debts first for quick wins. |

| 📉 Debt Avalanche | Prioritizes debts with the highest interest rates. |

| 🎯 Motivation | Snowball builds momentum; avalanche saves more in interest. |

| ✅ Right Choice | Depends on your financial situation and personal preferences. |

Frequently Asked Questions

▼

The main difference lies in the prioritization: debt snowball focuses on the size of the debt, while debt avalanche focuses on the interest rate. Snowball is motivational; avalanche is economical.

▼

The debt avalanche method typically saves more money in the long run because it targets high-interest debts first, reducing the overall cost of borrowing and interest paid.

▼

The debt snowball method isn’t ideal for everyone. It works best for those who need quick wins to stay motivated. If you are comfortable, focus on the long-term savings using avalanche.

▼

Yes, you can combine elements of both methods, targeting a small debt with high interest or a small debt to get started. It is crucial to do what works best for you.

▼

If your interest rates are similar, the debt snowball method might be a better fit, as the psychological boost of paying off smaller debts can help you stay motivated and stick to your plan.

Conclusion

Choosing between the debt snowball vs. debt avalanche: which strategy saves you more money in the long run? depends greatly on individual preferences and financial situations. While the debt avalanche typically saves more money, the debt snowball’s motivational benefits can’t be overlooked. Select the strategy that aligns with your needs, ensuring commitment and consistency to achieve lasting debt freedom.