Investment Diversification: Your Guide to Weathering Market Volatility

Investment diversification is a strategy to mitigate risk by spreading investments across various asset classes, industries, and geographic regions, helping to protect your portfolio against market downturns and enhance long-term returns.

Navigating the complexities of the financial markets requires a strategic approach, and investment diversification: how to build a portfolio that can weather any market condition stands as a cornerstone of sound financial planning, protecting your assets and ensuring long-term growth, no matter the economic climate.

Understanding Investment Diversification

Investment diversification is the practice of spreading your investments across a variety of asset classes, industries, and geographic regions. This strategy aims to reduce the risk associated with investing by ensuring that a single event or market downturn does not significantly impact your entire portfolio. Understanding the principles and benefits of diversification is essential for building a resilient and profitable investment strategy.

The Importance of Risk Management

Effective risk management is paramount in investing, and diversification serves as a primary tool in achieving this. By allocating investments across different sectors, you can minimize the potential for substantial losses if one sector underperforms. A well-diversified portfolio is designed to balance risk and reward, providing a smoother path to long-term financial goals.

Diversification vs. Hedging

While both diversification and hedging are risk management strategies, they differ in their approach. Diversification aims to reduce risk by spreading investments, while hedging involves taking positions that offset potential losses in other investments. Diversification is a broader strategy, whereas hedging is more targeted and often involves using financial instruments like options or futures.

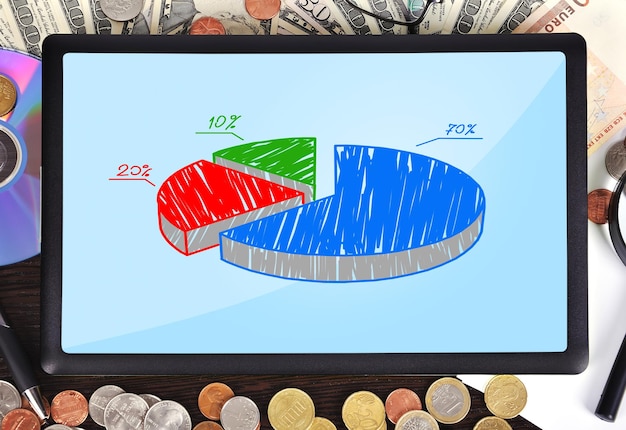

- Asset Allocation: Diversification begins with asset allocation, determining the proportion of your portfolio invested in different asset classes such as stocks, bonds, and real estate.

- Industry Diversification: Spreading investments across various industries can protect against sector-specific downturns.

- Geographic Diversification: Investing in different countries and regions can mitigate risks associated with local economic conditions.

In essence, investment diversification is a strategic approach to mitigating risk while aiming for consistent returns. By understanding its core principles and continuously adjusting your portfolio, you can create a more secure and prosperous financial future. This approach ensures that your investments are not overly reliant on any single asset, industry, or region, thereby enhancing the resilience of your portfolio.

Asset Allocation Strategies

Asset allocation is the process of dividing your investment portfolio among different asset categories, such as stocks, bonds, and cash. The goal of asset allocation is to balance risk and reward in a way that aligns with your investment objectives, time horizon, and risk tolerance. Different asset allocation strategies can significantly impact your portfolio’s performance and resilience.

Stocks (Equities)

Stocks represent ownership in a company and offer the potential for high returns but also come with higher risk. Investing in a diversified mix of stocks, including large-cap, mid-cap, and small-cap companies, as well as international stocks, can help balance this risk.

Bonds (Fixed Income)

Bonds are debt securities issued by corporations or governments. They typically offer lower returns than stocks but are considered less risky. Bonds can provide a stable income stream and act as a buffer during market downturns. Diversifying across different types of bonds, such as government bonds, corporate bonds, and municipal bonds, can further reduce risk.

Alternative Investments

Alternative investments include asset classes such as real estate, commodities, and private equity. These investments can offer diversification benefits because they often have low correlation with traditional asset classes like stocks and bonds. However, alternative investments may also be less liquid and more complex.

- Age-Based Allocation: A common strategy is to adjust your asset allocation based on your age and time horizon. Younger investors typically allocate a larger portion of their portfolio to stocks, while older investors shift towards more conservative investments like bonds.

- Risk Tolerance Assessment: Understanding your risk tolerance is crucial for determining the appropriate asset allocation. Investors with a higher risk tolerance may be comfortable with a larger allocation to stocks, while those with a lower risk tolerance may prefer a more conservative mix.

- Regular Rebalancing: Over time, your asset allocation may drift away from your target due to market fluctuations. Regularly rebalancing your portfolio by buying and selling assets to restore your original allocation is essential for maintaining your desired risk profile.

Strategic asset allocation is a cornerstone of successful investment management. By considering your individual circumstances, conducting thorough research, and regularly reviewing and adjusting your portfolio, you can build a well-diversified portfolio that aligns with your financial goals and risk tolerance. A balanced and diversified approach will help mitigate risk and position you for long-term financial success.

Diversifying Across Different Sectors and Industries

Diversifying across different sectors and industries is a critical component of a well-rounded investment portfolio. Sectors represent broad areas of the economy, such as technology, healthcare, and finance, while industries are more specific groups within those sectors. By spreading your investments across various sectors and industries, you can reduce the impact of any single sector’s performance on your overall portfolio.

Technology Sector

The technology sector includes companies involved in software, hardware, and internet services. While it offers significant growth potential, it can also be volatile. Diversifying within the technology sector by investing in different types of tech companies can help mitigate risk.

Healthcare Sector

The healthcare sector includes companies involved in pharmaceuticals, medical devices, and healthcare services. It is generally considered a defensive sector because demand for healthcare products and services tends to be stable even during economic downturns.

Financial Sector

The financial sector includes banks, insurance companies, and investment firms. It is sensitive to interest rate changes and overall economic conditions. Diversifying within the financial sector by investing in different types of financial institutions can help manage risk.

- Economic Cycles: Different sectors tend to perform differently during various stages of the economic cycle. Investing in a mix of cyclical and defensive sectors can help balance your portfolio.

- Industry Research: Conduct thorough research on the industries you are considering investing in. Understand the factors that drive their performance and the potential risks they face.

- Index Funds and ETFs: Sector-specific index funds and ETFs can provide a convenient way to diversify across different sectors and industries.

By diversifying across different sectors and industries, investors can create a more resilient and balanced portfolio. This approach helps to mitigate the risks associated with sector-specific downturns and positions the portfolio to benefit from growth opportunities across various areas of the economy. A well-diversified portfolio ensures that your investments are not overly reliant on the performance of any single sector, enhancing long-term stability.

Diversification Through Geographic Regions

Geographic diversification involves investing in companies and assets located in different countries and regions around the world. This strategy aims to reduce the risk associated with investing in a single country’s economy or political environment. Exposure to different markets can also provide access to growth opportunities that may not be available in your home country.

Developed Markets

Developed markets, such as the United States, Europe, and Japan, generally have stable economies and well-established financial systems. Investing in these markets can provide a solid foundation for your portfolio.

Emerging Markets

Emerging markets, such as China, India, and Brazil, offer higher growth potential but also come with greater risk. These markets may be more volatile and subject to political and economic instability.

Understanding Global Economic Trends

Staying informed about global economic trends is essential for making informed investment decisions. Factors such as currency exchange rates, trade policies, and geopolitical events can impact the performance of international investments.

- Currency Risk: Investing in foreign assets exposes you to currency risk, which is the risk that changes in exchange rates will negatively impact your returns. Diversifying across multiple currencies can help mitigate this risk.

- Political Risk: Political instability and policy changes can impact the performance of investments in certain countries. Assessing political risk is an important part of the international investment process.

- International Funds and ETFs: Investing in international funds and ETFs can provide a diversified exposure to global markets. These funds are managed by professionals who have expertise in international investing.

Diversifying through geographic regions is a strategic approach to enhancing portfolio stability and capturing global growth opportunities. By considering economic and political factors, understanding currency risk, and utilizing international funds, investors can build a well-diversified portfolio that is positioned to succeed in a globalized world. This strategy ensures that your investments are not overly concentrated in any one country, thereby reducing vulnerability to local economic downturns.

Rebalancing Your Portfolio

Rebalancing your portfolio involves periodically adjusting your asset allocation to bring it back in line with your original target. Over time, market fluctuations can cause your asset allocation to drift away from your desired mix. Rebalancing helps to maintain your desired risk profile and can also provide opportunities to buy low and sell high.

When to Rebalance

There are two primary approaches to rebalancing: calendar-based and threshold-based. Calendar-based rebalancing involves rebalancing at regular intervals, such as quarterly or annually. Threshold-based rebalancing involves rebalancing when your asset allocation deviates from your target by a certain percentage.

Tax Implications of Rebalancing

Rebalancing can have tax implications if it involves selling assets that have appreciated in value. It’s important to consider the tax consequences of rebalancing and to use tax-advantaged accounts whenever possible.

The Benefits of Staying Disciplined

Regularly rebalancing your portfolio requires discipline and can help you avoid making emotional investment decisions. By sticking to your rebalancing plan, you can stay focused on your long-term financial goals and avoid being swayed by short-term market volatility.

- Calendar-Based Rebalancing: This method involves rebalancing your portfolio at fixed intervals, such as quarterly, semi-annually, or annually, regardless of market conditions.

- Threshold-Based Rebalancing: With this approach, you set a specific percentage threshold for each asset class. When an asset class deviates from its target allocation by this threshold, you rebalance the portfolio.

- Review and Adjust: It’s essential to periodically review your rebalancing strategy to ensure it still aligns with your investment goals and risk tolerance. Market conditions and personal circumstances may necessitate adjustments to your approach.

Rebalancing is a crucial tool for maintaining a well-diversified and risk-appropriate investment portfolio. By understanding the different methods of rebalancing, considering tax implications, and staying disciplined, investors can enhance their long-term investment success. Consistently managing your asset allocation aligns your investments with your goals and mitigates the impact of market fluctuations.

Common Pitfalls to Avoid in Diversification

While diversification is a powerful tool for managing risk, there are several common pitfalls that investors should avoid. Over-diversification, failure to rebalance, and neglecting to understand the underlying investments can all undermine the effectiveness of a diversification strategy. Being aware of these pitfalls and taking steps to avoid them is essential for achieving your financial goals.

Over-Diversification

It is possible to over-diversify your portfolio by holding too many different investments. This can lead to diminished returns and increased transaction costs. Focus on holding a sufficient number of investments to achieve diversification without becoming overly diluted.

Failure to Rebalance

Failing to rebalance your portfolio can lead to a drift away from your desired asset allocation, increasing your risk exposure. Regularly rebalance your portfolio to maintain your desired risk profile.

Neglecting to Understand Underlying Investments

It’s crucial to understand the investments you are holding in your portfolio. Don’t invest in something you don’t understand. Take the time to research and understand the risks and potential returns of each investment.

- Diworsification: This occurs when adding more investments to your portfolio actually decreases returns and increases risk due to a lack of focus.

- Correlation Neglect: Failing to consider the correlation between different assets in your portfolio can reduce the effectiveness of diversification. Assets should ideally have low or negative correlations to provide true diversification benefits.

- Ignoring Fees and Expenses: Excessive fees and expenses can erode the returns of a diversified portfolio. Be mindful of the costs associated with your investments and choose cost-effective options whenever possible.

To achieve successful investment diversification, investors must be vigilant in avoiding common pitfalls. By focusing on quality over quantity, understanding the correlations between assets, and regularly reviewing and rebalancing their portfolios, they can build resilient and profitable investment strategies. This informed and disciplined approach ensures that your portfolio remains aligned with your goals and risk tolerance.

| Key Point | Brief Description |

|---|---|

| 🛡️ Risk Mitigation | Spreading investments reduces the impact of poor performance in one area. |

| 📊 Asset Allocation | Divide investments among stocks, bonds, and other assets based on risk tolerance. |

| 🌍 Geographic Spread | Invest in different countries to protect against local economic issues. |

| 🔄 Rebalancing | Adjust your portfolio to maintain your original asset allocation over time. |

Frequently Asked Questions

▼

The primary goal is to reduce risk. By spreading your investments across different asset classes and sectors, you minimize the impact of any single investment performing poorly, protecting your overall portfolio.

▼

There’s no magic number, but a good starting point is at least 20-30 different stocks and bonds across various sectors. This can be achieved through mutual funds or exchange-traded funds (ETFs).

▼

No, diversification cannot guarantee against losses. However, it significantly reduces the risk of substantial losses, especially during market downturns. All investments carry some level of risk.

▼

A common approach is to rebalance annually or when an asset class deviates from its target allocation by more than 5-10%. This ensures your portfolio stays aligned with your risk tolerance.

▼

Alternative investments include real estate, commodities (like gold or oil), private equity, and hedge funds. These can offer diversification benefits due to their low correlation with traditional assets.

Conclusion

In conclusion, investment diversification: how to build a portfolio that can weather any market condition is a crucial element of successful financial planning. By spreading your investments across various asset classes, sectors, and geographic regions, you can mitigate risk and improve your chances of achieving long-term financial goals, regardless of market volatility.